April Newsletter & AI Tech Strategy

Business news, travel trends, update on EU legislation and Airbnb, plus new tech, investments and of course our lead in to the Big Report on why when you have been adopting tools, it may be a mistake!

AI isn't just coming; it's here and reshaping the short-term rental industry. This month's exclusive deep dive cuts through the hype, exposing the critical challenges of fragmented tech stacks and legacy systems. We reveal why current AI approaches fall short and what you, as a professional manager, must do now to avoid being left behind. Get the essential insights to navigate the AI revolution and protect your business.

May Newsletter Coming

May's newsletter will focus on a global trend that managers need and that tech companies are reaching into. This trend is supported and driven by post-COVID economies and work habits. Don’t miss it!

THE AI REPORT

AI & Rental Tech. Look before you leap!

This separate newsletter is linked below the Industry News section.

71% of respondents say their organizations regularly use gen AI in at least one business function, up from 65% percent in early 2024. (McKinsey)

INDUSTRY NEWS

ONE TO WATCH

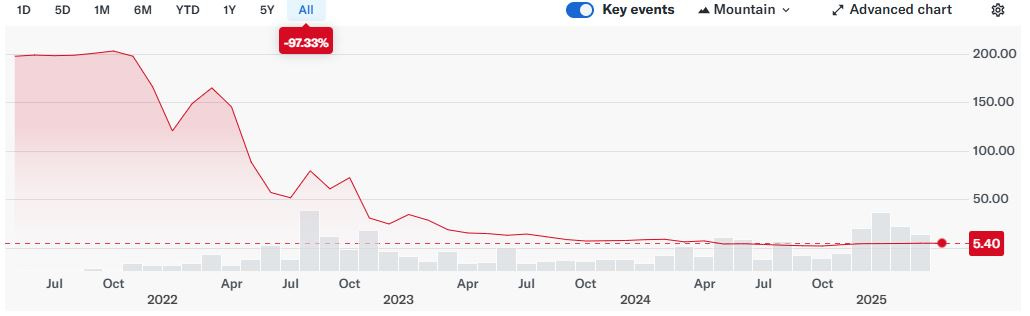

One of the most significant pieces of news that keeps giving is Casago’s bid for Vacasa, converting a percentage of Vacasa-owned management companies into franchises, and the expansion of other franchises. This is a lot of news; a counterbid included a former owner and two sides of the argument. Why can’t a company with a 40%+ take rate make money, and is a franchise a better solution?

Opinion: Watching this video of the CEO of Casago, it confirmed our thoughts that this may be the solution to a company in a spiral of death. In a hyper-local industry, only certain things can be seeded centrally, and management and shareholder values need to be looked at through a different lens. Maybe it could be turned around, but enough time and rope has been given. The slide has been momentous: Filing its full-year 2024, Vacasa noted a decline in headcount from 6,400 in 2023 to 4,300 at the end of last year. It also said its direct booking share had declined from 40% in 2023 to 30% in 2024. Now we see VTrips also looking to need finance!

Note: After writing this and having had the privilege of meeting Steve last week and witnessing his approach to business and the people compass, shareholders could not look to do better than support this move in an industry with such hyperlocal needs and the Human H in Hospitality.

EQUALLY MAJOR NEWS (In Europe)

HomeToGo Group entered into a binding agreement to acquire Interhome, a Switzerland-based rental company that manages approximately 40,000 properties in 20 countries. Notably, Interhome is part of the Migros corporation, the largest retail company in Switzerland.

The financial terms of the transaction involve a purchase price of around €160 million (approximately £133.5 million) and deferred payments that could reach up to €90 million (approximately £75 million).

In a related development, the international tourism group Dertour has announced a separate agreement to acquire the remaining entities of Hotelplan. Hotelplan is the Migros company that previously encompassed Interhome.

HomeToGo, was established in 2014, and both B2C and B2B. The Berlin-based rental company anticipates that HomeToGoPRO, its B2B segment, will evolve into its primary source of revenue. The company's key objectives include expanding its base of homeowners, enhancing marketing efficiency, and elevating the overall guest experience.

Beyond merely broadening its offerings through the acquisition of Interhome, HomeToGo is also focused on augmenting its software and technology-enabled service solutions portfolio. Following the acquisition, Interhome's existing management team is expected to remain in their current roles, and all Interhome employees are expected to be retained.

Opinion: What was a meta search engine, publicly listed and owner of the PMS (Smoobu) has decided to get into property management, a tech play underpinned by personal service. The US seems to suffer at scale (Vacasa, VTRips), but in Europe, the big management companies (agencies) make money. Probably not enough to please their PE backers, but it pays the interest!

Will this work? Interhome is old and undoubtedly technically challenged, and Hometogo is more modern, so this makes sense, although execution could be painful. The question is operational management and a different culture and mindset. Presumably, Interhome is buying profit (currently loss-making) as meta and large marketplace positioning is hard, and Expedia, Airbnb, and Booking have habitual guests, which Hometogo works with to a degree.

So worth watching for sure. However, are the 40,000 exclusive properties as Interhome exclusive as they have remarketed thousands of third-party properties in the past? However, that works out at €6,250 per property if the € 250 m is realised. Looks like a half-decent deal, but the devil is in the details.

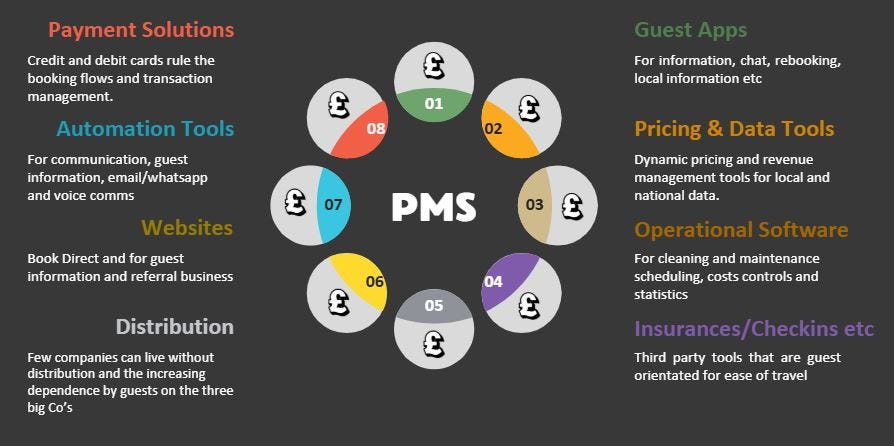

APP FATIGUE

We watched this Video on a core subject right now: apps, overtech and can an API fed, best in class app approach to a STR tech stack compete with a compound system (read our big article this month). This VRBO-promoted business couple run 15 apps (two are a PMS and Breezeway) for 50 properties. I must admire them, but what a complex environment they exist in. Take a listen:

Their apps are: Orbi, Parcele, Minut, FSB (Farmers State Bank),Pentair,Kwikset,Schlage,Notes ,MyQ Garage System,MyQ Smart Video Keypad,Wyze,Sensi App,Wedding Pro,Breezeway and Uplisting.

Opinion: Well done, but not for any managers in our client base! Go compound or go home in the future. Also, VRBO promoted and was curious about their mkt dept for this focus.

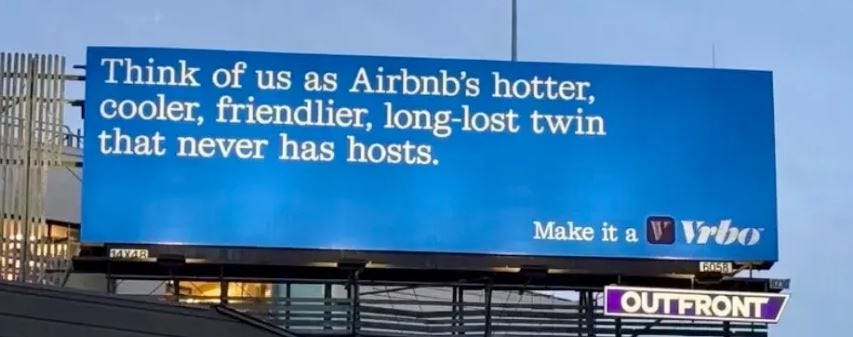

OTA WARFARE

It's good for a laugh, but it does show the value of the STR market and the lengths companies will go to in the quest for guest nights and image.

Vrbo recently placed provocative billboards near Airbnb's headquarters and in several major cities, branding itself as a cooler alternative to Airbnb. Airbnb dismissed Vrbo’s campaign as confused and desperate, ironically giving Airbnb more visibility.

Vrbo defended the ads, claiming they highlight its advantages—privacy and exclusive spaces compared to Airbnb’s model, which sometimes includes shared accommodations. The billboard campaign reflects the competitive tensions as Airbnb dominates the short-term rental market with a significantly larger share and continues to grow, with 70% of its $11B+ revenue coming from five key markets (US, UK, Canada, France, Australia). Four hundred thousand low-rated properties have been removed to improve quality overall. Airbnb looks to be evolving into a comprehensive travel and living brand with a host of upcoming platform improvements.

Opinion: Let them get on with it, but these companies will squeeze harder on cancellation fees, payment management and loyalty programs, bundling and discounting your properties. Airbnb Cohosts may not be a great idea as the successful ones are essentially “managers” and lose loyalty and start to multi-channel. Our presentation includes OTA direction to be published after the Air Success conference in London on April 4th and on our website.

TRAVEL

Depending on where you are reading this, air passenger information is one of the most quickly reported data sets and gives insights into where travel is happening. January looks to have been a good month. How does this align with your business, either international or domestic?

Total demand, measured in revenue passenger kilometers (RPK), was up 10.0% compared to January 2024. Total capacity, measured in available seat kilometers (ASK), was up 7.1% year-on-year. The January load factor was 82.1% (+2.2 ppt compared to January 2024), an all-time high for January.

International demand rose 12.4% compared to January 2024. Capacity was up 8.7% year-on-year, and the load factor was 82.6% (+2.7 ppt compared to January 2024), an all-time high for January.

Domestic demand rose 6.1% compared to January 2024. Capacity was up 4.5% year-on-year. The load factor was 81.2% (+1.2 ppt compared to January 2024), an all-time high for January.

Plenty of detail on this link: https://www.iata.org/en/pressroom/2025-releases/2025-02-27-02/

This is another tool that is useful for US stats too if you’re a “grapher”

https://www.tsa.gov/travel/passenger-volumes/2024

Opinion: Travel shows no signs of slowing and projections to 2030 are high globally. People travel and increasingly so. Make sure you are in the eyeline!

TRENDS

Combining trips is not new in what used to be called “Bleisure,” but they are definitely on the increase.

A new Crowne Plaza by IHG report reveals that blended travel—combining business trips with leisure—is rapidly growing. 66% of US and UK travelers now mix work and leisure, up from 53% in 2022. Globally, 67% of respondents agree that blended travel offers beneficial flexibility, reflecting a fundamental shift toward remote work and flexible office policies.

Crowne Plaza emphasizes its active role in accommodating and shaping this trend through innovative hotel designs, social spaces, and tailored experiences.

Some 56% of the travellers from the US and UK who participated in the report said the ability to travel while working is “a key benefit” of remote work.

Opinion: Ignore this trend at your peril and make sure the work part of your properties is also accommodated

LOCKING THE DOOR

Key boxes have been popular globally and more challenging to break into than Fort Knox, but not very sightly! Visit Como and walk down the back streets to see some spectacular box collections on metal fencing!

These lock boxes are being removed from public property in Rome and Florence's historic centers. These devices have become emblematic of the social challenges arising from over-tourism. In response, Italy's interior ministry has issued a notice requiring their removal, with a €400 penalty for those who fail to comply. Meet and greet is back!

Opinion: This is tough on the single property owner. Managers may have an office, and full blocks can have a key code and automated entry (but this is being challenged, too). Companies like Keysnest have supported these keyholder challenges and have a local solution!

We noticed that Skift published a very long 2025 megatrends report and a very short summary below—nothing new for STRs except longer stays, more experiences and professionalization. The big takeaway and alignment to managers' conversations is of single block apart/hotel preferences as distributed management gets harder: full control.

GLOBAL INFLUENCES

Shift in Traveler Priorities: Travelers are becoming more selective about their destinations, considering the impact of their trips. This includes a preference for "slow travel," where visitors spend more time in fewer locations, and a rising interest in voluntourism.

Relevance of Domestic Tourism: Domestic tourism has grown significantly and is supported by more straightforward health requirements and a desire to support local businesses.

Resurgence of Cities: Despite initial predictions of their decline, cities have rebounded strongly. They attract travelers with cultural experiences, improved urban spaces, and technological innovations.

Changing Nature of International Travel: International travel is recovering, with a focus on more extended stays and deeper exploration. Technology is facilitating this through contactless processes and improved immigration procedures.

The distinction between traditional hotels and short-term rentals is becoming less defined, with major booking sites listing various accommodation types together. Airbnb is expanding into boutique hotels, and hotel chains like Marriott and Hilton are entering the short-term rental market.

Professionalization and Regulation in Short-Term Rentals: The short-term rental sector is seeing increased influence from professional vacation rental managers. These managers can standardize the guest experience but may reduce the emphasis on local character. Cities are also implementing more regulations on short-term rentals, which is affecting the market.

Europe Tightens STR Regulations

Barcelona: Spain’s Constitutional Court has upheld Barcelona’s plan to eliminate all short-term rental (STR) licenses by 2028, affirming the city’s legal authority and dismissing property rights objections. Over 10,000 tourist apartments will be affected.

Lisbon: The city has frozen new STR licenses in 19 neighborhoods and 8 parishes, including a complete ban in historic districts like Bairro Alto and Alfama. No new licenses are allowed where STRs exceed 5% of housing stock. Public consultation is open until April 15, 2025.

Marseille: STR stays in primary residences are now capped at 90 days per year. Backed by France’s new Le Meur Law, the city is boosting enforcement with fines up to €20,000 and launching an “Airbnb brigade” to target illegal listings.

Amsterdam: STR stays are being reduced to 15 nights per year in select districts due to ongoing nuisance complaints. A broader citywide debate is expected by the end of 2025, with new rules taking effect in April 2026.

Italy: Airbnb now collects and remits tourist taxes in over 1,200 municipalities, including Venice and Rome, under the 2024 Budget Law. The move aims to ensure tax compliance and relieve guests from local tax paperwork.

UK: For all UK legislative information, please visit PASCUK, the premier association for managers and owners alike.

MORE TECH! Websites!

Founded in 2020, Goliday is a startup designed to simplify the creation of booking websites for holiday rental owners. It allows them to drive direct bookings, establish their brand, and lessen their dependence on platforms and their fees. The company aims to make rental website creation accessible and provide comprehensive booking management tools. Backed by six-figure funding from the European Union (EU), Goliday has completed a pre-seed funding round and is currently seeking seed investment, with advisory support from Vienna-based advisory firm i5invest.

Goliday has ambitions to compete with industry giants like Airbnb and Booking.com by offering a platform for owners to advertise their properties, including the upcoming launch of its Goliday B2C holiday rental marketplace.

The company has already generated €9 million in booking volume for its clients across 5,500 websites.

Goliday aims to accelerate its European and global expansion, targeting new markets such as Italy, Spain, Croatia, and the United States.

Opinion: I wish this team well. However, as a Book Direct option from your shopfront, we work with companies that process twice this from a portfolio of 200 properties. It's the same challenge that all web businesses face. The industry needs an “intelligent”, AI-driven, instant web offering with full PMS connectivity and upsell extras. It needs to be designed around intent SEO, dynamic, informative, trustworthy (single-known brand), and a lot of marketing money!

Also, without an angle or a war chest of money, the Goliday B2C holiday rental marketplace may not be the best idea!

SHOUTOUT FOR YHANGRY

As the website says: “Find a private chef for your next event with a company on a mission to redefine the way people dine at home and in holiday rentals”

This is no ordinary organisation. It has thousands of chefs, fantastic reviews, and is used by hundreds of managers to support that all-important guest experience. AND the managers make money from it, too. It's a win-win for all involved. Check it out.

THE AVIO GROUP

This is a soft launch video from The AVIO Group, a team of pretty well-known individuals who are working with management companies and expanding their business into another dimension. They help build beautiful businesses.

YES UPDATES

This newsletter is brought to you by Yes.Consulting with two of its own news pieces.

Yes.Consulting is now Trademarked and will change its logo accordingly

We are welcoming Jannich F. Petersen to our business. With nearly a decade leading Spain-Holiday.com, he played a key role in shaping the company’s growth from startup to a consolidated business, leading a team of 40 professionals.

Originally from Denmark, Jannich has lived in Málaga for over 17 years and is fluent in English, Spanish, and Danish. His approach to leadership is defined by strategic vision, data-driven decision-making, and a deep understanding of digital business models.

Please visit his profile here.

CONFERENCES

We spoke at two conferences in April:

The Short Stay Summit in London, April 2nd

The Air Success Conference London April 4th

A lot is happening! We will cover this in the next newsletter. If you’re worried about your business's future and what others are doing, tune in to the next edition.

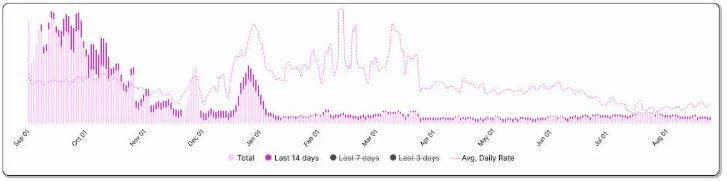

REVENUE MANAGEMENT HELP IS AT HAND

This link will take you to an excellent document from Wheelhouse on how to focus your attention and identify dates where pricing or availability adjustments will lead to higher revenue.

THE AI REPORT

The AI wave is hitting the short-term rental market, creating both massive opportunities and significant risks. This month, we go beyond the buzzwords to provide actionable strategies for professional managers. Understand the limitations of today's siloed AI tools, explore the game-changing potential of unified systems, and learn how to prepare your tech stack (and team!) for what's next. Future-proof your operations and gain your competitive edge with crucial insights you won't find elsewhere.

CONTENTS

71% of respondents say their organizations regularly use gen AI in at least one business function, up from 65% percent in early 2024. (McKinsey)

Fragmented AI Approach

The Compound Systems Approach

Why We Haven't Gotten There Yet + Path Forward

Current AI Tool Uses

Reported Real-World Use Cases

Investment Trends in AI & Hospitality

The Cost of Not Adapting

AI and Workforce Transformation

Ethical Use and Governance of AI

Preparing Your Tech Stack

A Vision of AI-Enhanced Guest Experience

Focus on the immediate challenges

Does your tech stack look anything like this? Then this article is for you.

Please note that this is for our paid subscribers, BUT a free subscriber gets a one off single use unlock. Subscribers can read previous articles such as the “Dynamic Pricing Question” or the “2024 full year roundup of M&A” etc.